Main category

Economics (General Management)

Abstract

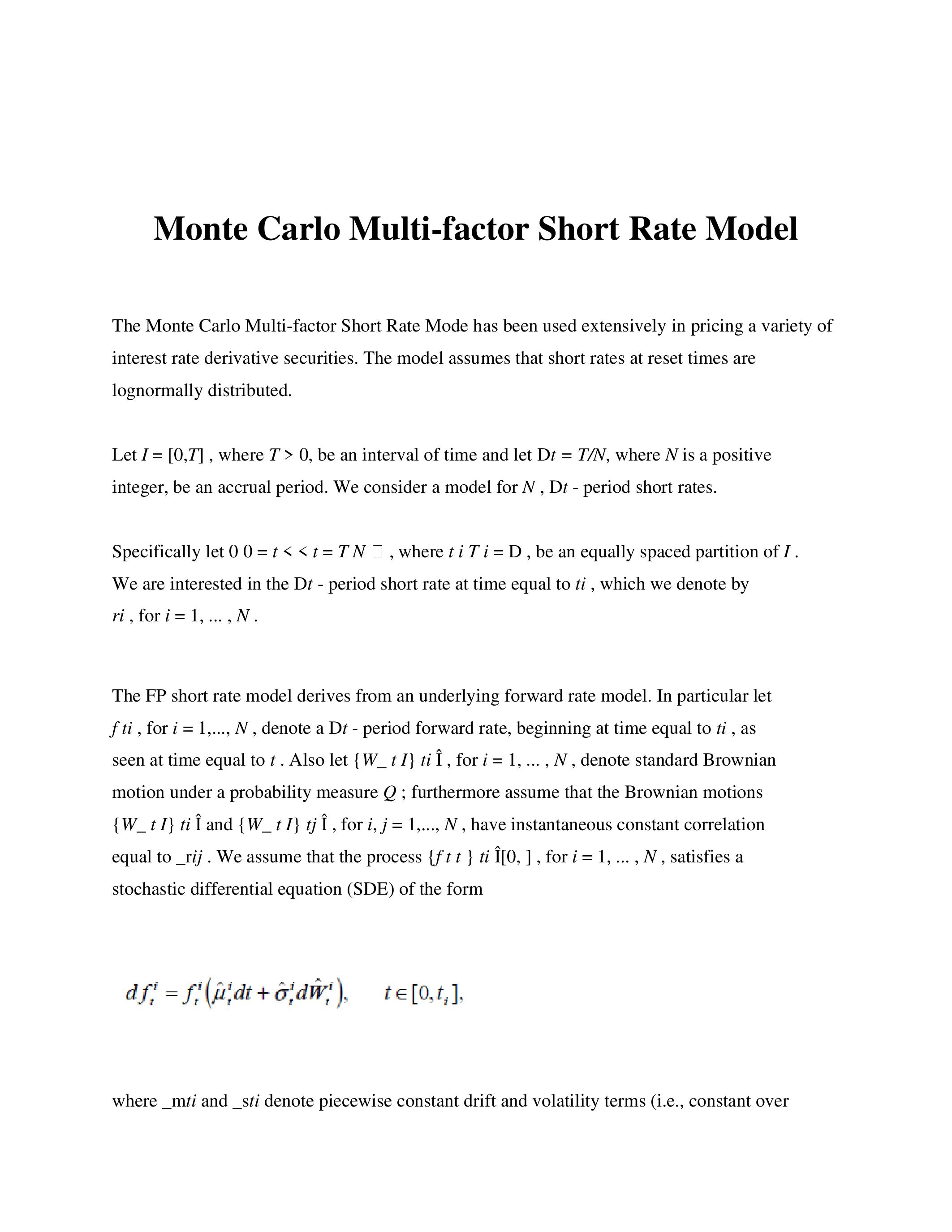

The Monte Carlo Multi-factor Short Rate Mode has been used extensively in pricing a variety of interest rate derivative securities. The model assumes that short rates at reset dates are lognormally distributed; the short rate at a reset time arises as the limiting spot value from a corresponding forward rate process, which is a geometric Brownian motion with drift. The short rate model is, by construction, arbitrage free, and numerical test results bear this out.

Further reading

https://ia904708.us.archive.org/12/items/monte-carlo-short-rate/MonteCarloShortRate.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.