Main category

Economics (Finance)

Abstract

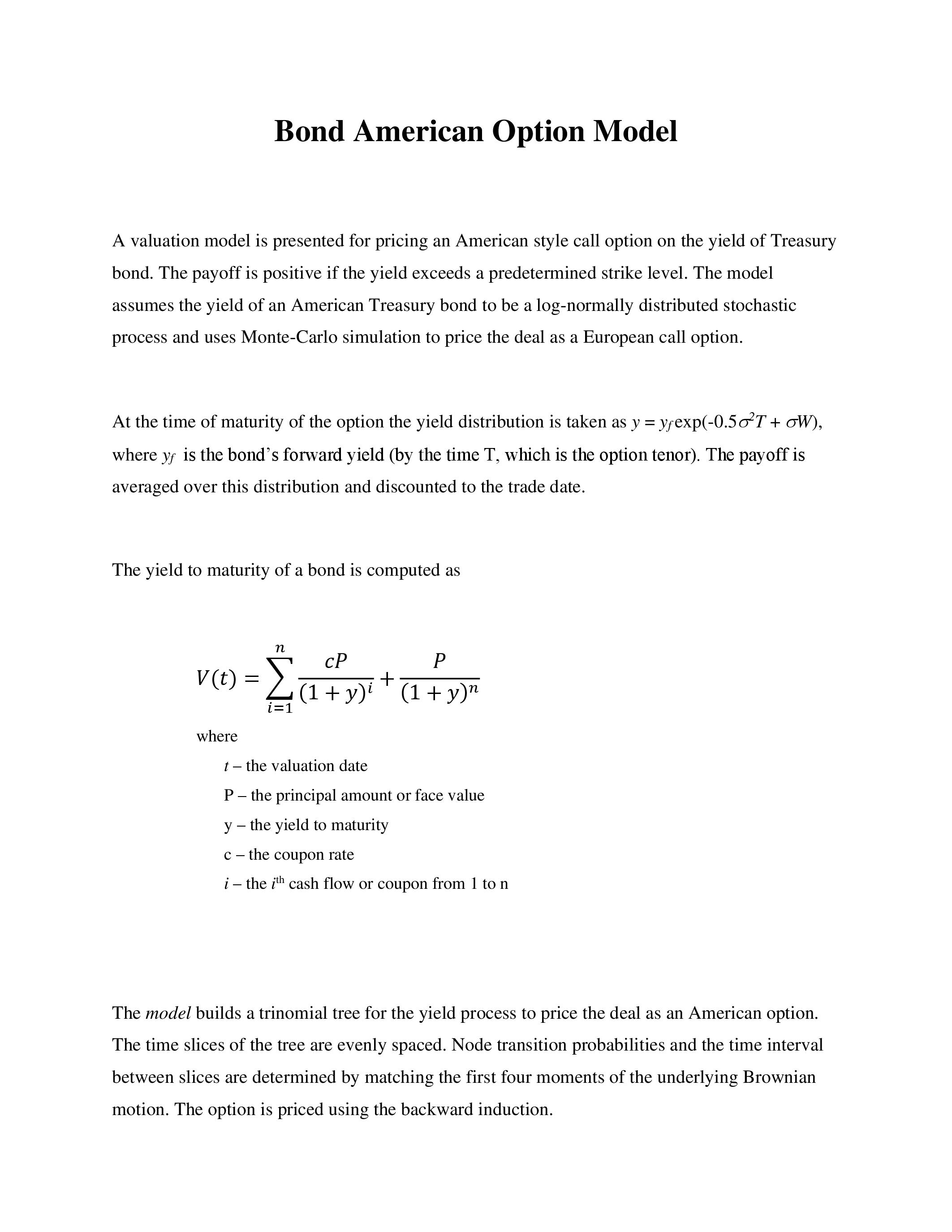

A valuation model is presented for pricing an American style call option on the yield of Treasury bond. The payoff is positive if the yield exceeds a predetermined strike level. The model assumes the yield of an American Treasury bond to be a log-normally distributed stochastic process and uses Monte-Carlo simulation to price the deal as a European call option.

Further reading

https://ia801909.us.archive.org/25/items/osfbond-american-option/OSFbondAmericanOption.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.