Main category

Economics (General Management)

Abstract

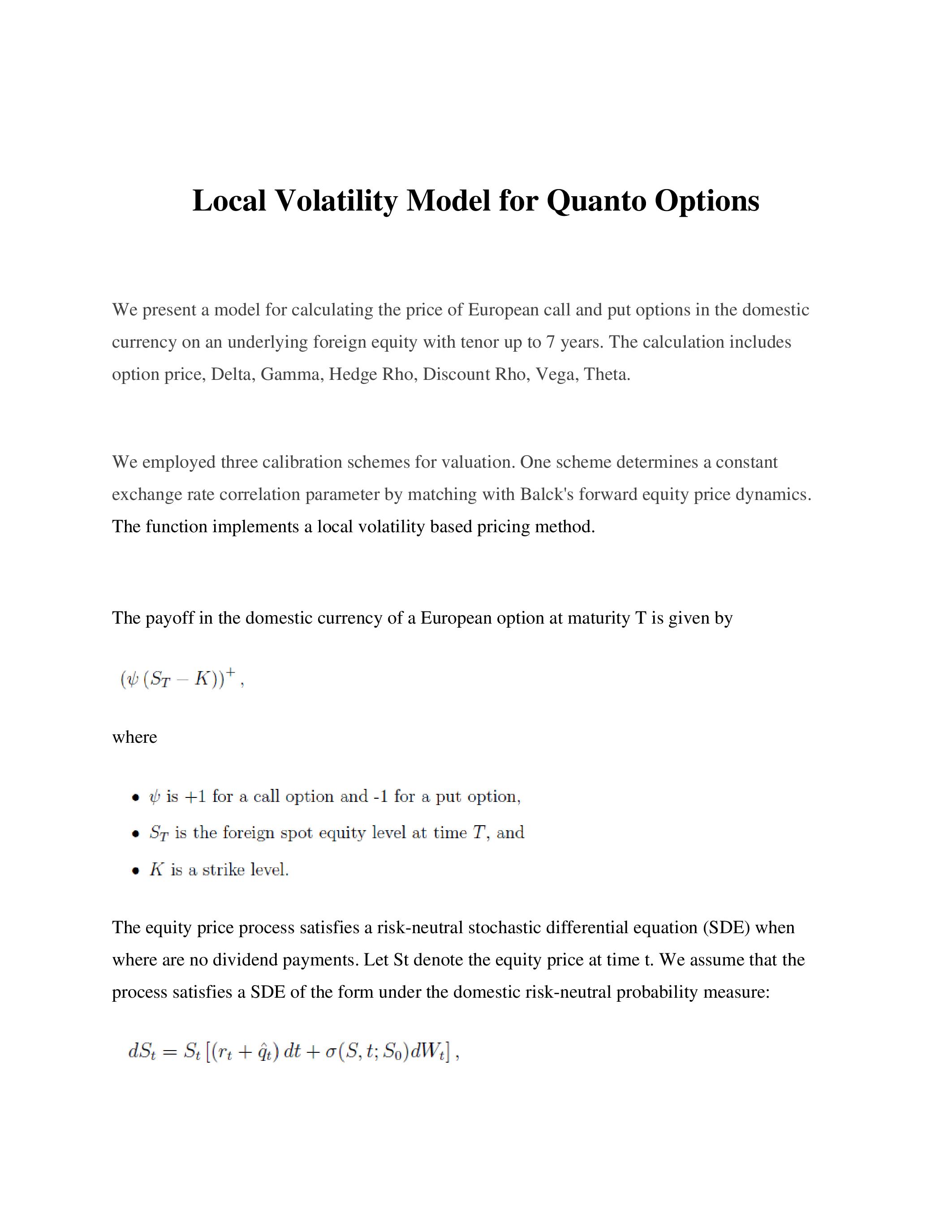

We present a model for calculating the price of European call and put options in the domestic currency on an underlying foreign equity with tenor up to 7 years. The calculation includes option price, Delta, Gamma, Hedge Rho, Discount Rho, Vega, Theta.

Further reading

https://ia904700.us.archive.org/23/items/local-vol-quanto/LocalVolQuanto.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.