Main category

Economics (General Management)

Abstract

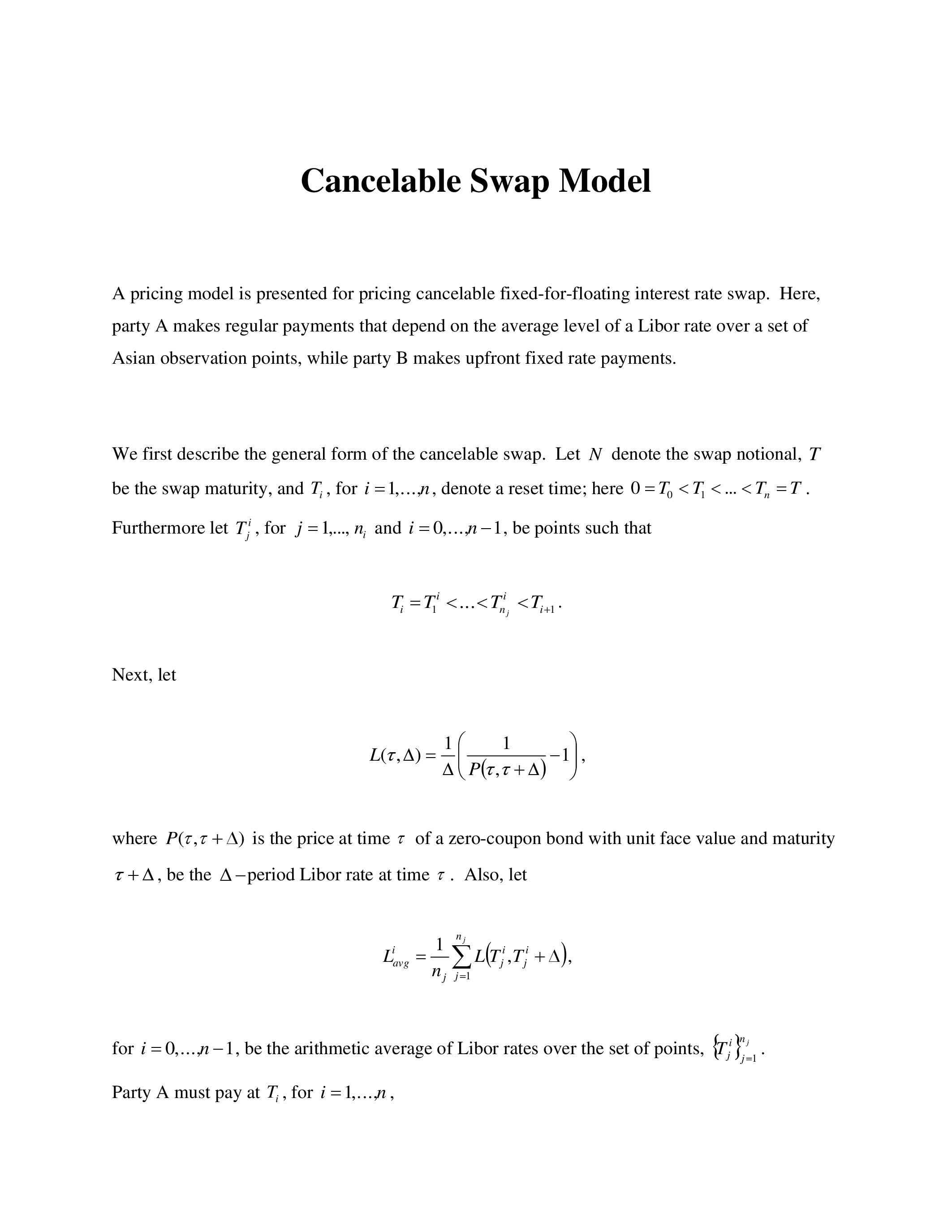

A pricing model is presented for pricing cancelable fixed-for-floating interest rate swap. Here, party A makes regular payments that depend on the average level of a Libor rate over a set of Asian observation points, while party B makes upfront fixed rate payments.

Further reading

https://ia904707.us.archive.org/17/items/cancellableSwap/cancellableSwap.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.