Main category

Economics (General Management)

Abstract

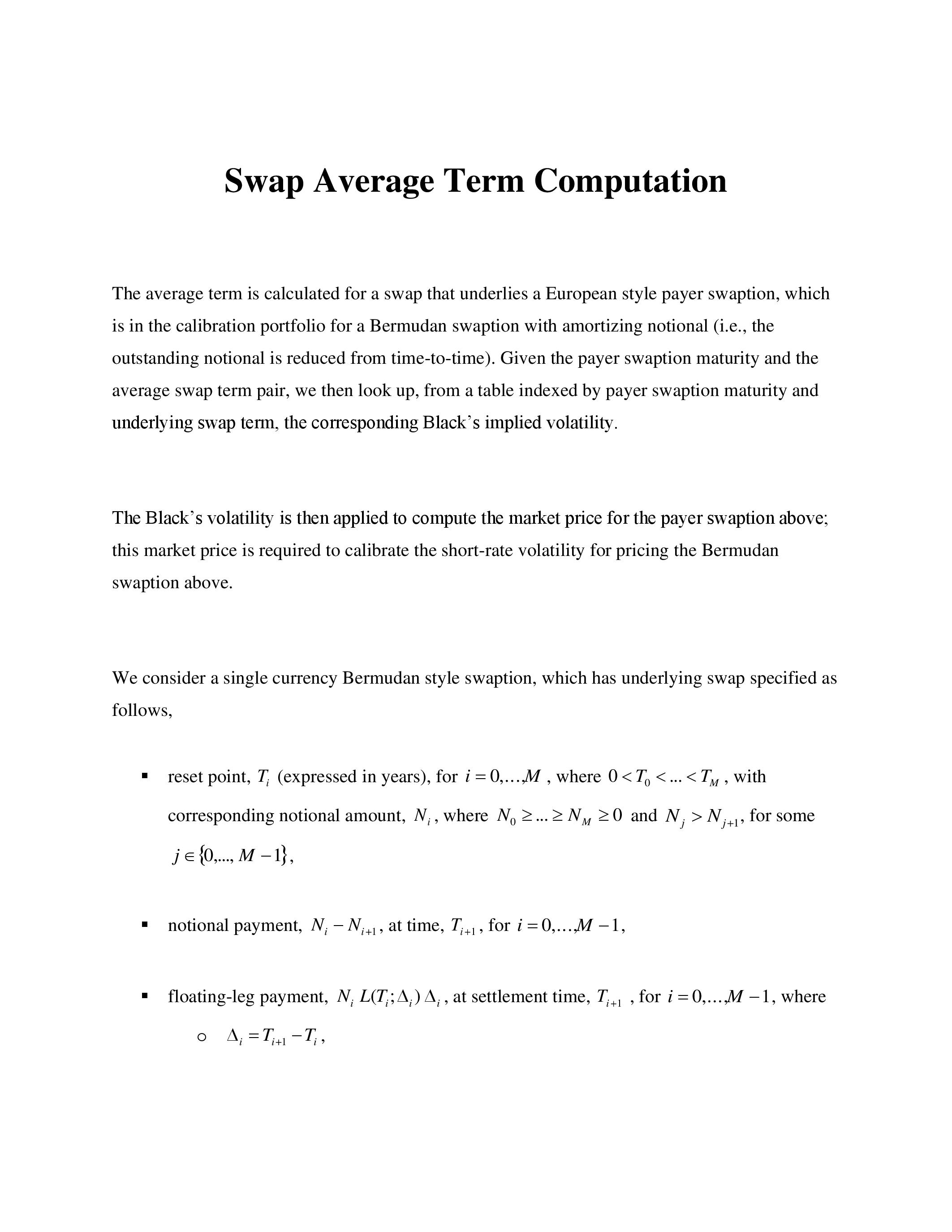

The average term is calculated for a swap that underlies a European style payer swaption, which is in the calibration portfolio for a Bermudan swaption with amortizing notional (i.e., the outstanding notional is reduced from time-to-time). Given the payer swaption maturity and the average swap term pair, we then look up, from a table indexed by payer swaption maturity and underlying swap term, the corresponding Black’s implied volatility.

Further reading

https://ia601500.us.archive.org/18/items/swap-average-term/SwapAverageTerm.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.