Main category

Economics (General Management)

Abstract

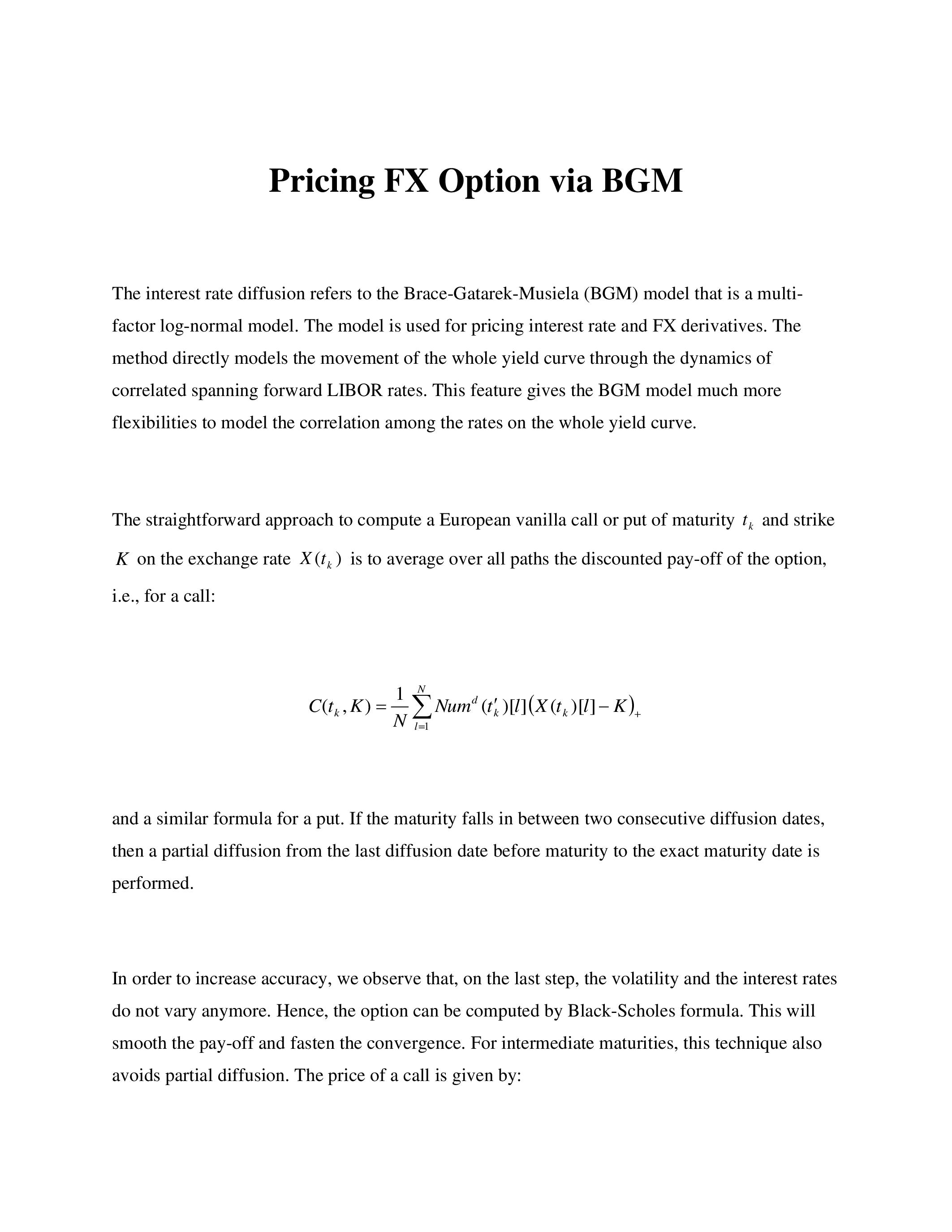

The interest rate diffusion refers to the Brace-Gatarek-Musiela (BGM) model that is a multi-factor log-normal model. The model is used for pricing interest rate and FX derivatives. The method directly models the movement of the whole yield curve through the dynamics of correlated spanning forward LIBOR rates. This feature gives the BGM model much more flexibilities to model the correlation among the rates on the whole yield curve.

Further reading

https://ia904708.us.archive.org/21/items/fxOptionBGM/fxOptionBGM.pdf

Do you have problems viewing the pdf-file? Download presentation

here

If the presentation contains inappropriate content, please

report the presentation. You will be redirected to the landing page.